|

Exploring

PCAOB Auditing Standard 2: Audits of Internal Control

By

Jack W. Paul

MAY 2005

- The Sarbanes-Oxley Act of 2002 requires public accounting

firms that audit public companies to register with the Public

Company Accounting Oversight Board (PCAOB) and to adhere to

professional standards established by the board for audits

of public companies. The PCAOB’s pronouncement, Auditing

Standard 2, An Audit of Internal Control Over Financial

Reporting Performed in Conjunction with an Audit of Financial

Statements, requires auditors to issue an opinion on

the effectiveness of their public company clients’ internal

control.

On

June 5, 2003, the SEC issued Release 33-8238 to implement

section 404(a) of the Sarbanes-Oxley Act (SOA), which requires

management to include in the annual report to shareholders

its assessment of the effectiveness of internal control.

The company’s external auditors must attest to and

report on management’s assessment for fiscal years

beginning on or after January 15, 2006, for accelerated

filers, and on or after July 15, 2006, for nonaccelerated

filers. Standard 2 imposes many new responsibilities on

public companies’ auditors and, by extension, on the

public companies themselves. In its over 200 pages, Standard

2 delineates the PCAOB’s expectations for an internal

control audit.

Overview

of an Internal Control Audit

Although

Standard 2 defines an “audit” as an integrated

audit of both the financial statements and internal control,

separate examination of the internal control audit facilitates

understanding. Standard 2 identifies the following important

steps in an audit of internal control:

-

Plan the audit.

- Evaluate

management’s assessment process.

-

Obtain an understanding of internal control.

- Test

and evaluate design effectiveness.

-

Test and evaluate operating effectiveness.

-

Evaluate the sufficiency of testing.

-

Formulate an opinion on the effectiveness of internal

control over financial reporting.

-

Issue a report on internal control.

-

Communicate findings to the audit committee and management.

Although

auditors routinely carry out some of the foregoing steps

in a financial statement audit, the audit of internal control

requires more extensive procedures, coupled with some requirements

that break new ground. Key implementation issues include

the following:

-

Differentiating between management and auditor responsibilities;

- Identifying

entities to include in the consolidated group;

-

Selecting testing locations;

-

Distinguishing design effectiveness from operating effectiveness;

-

Considering issues related to the “as of”

date;

-

Deciding on the extent of control testing;

-

Using the work of others;

-

Distinguishing between a material weakness and a significant

deficiency; and

- Reporting

results to management and financial statement users.

Differentiating

Between Management and Auditor Responsibilities

Management’s

responsibilities. Standard 2 requires management

to do the following:

-

Accept responsibility for the effectiveness of the company’s

internal control over financial reporting.

-

Evaluate the effectiveness of internal control over financial

reporting, using suitable control criteria such as the

COSO framework or an alternative recognized framework

developed by body of experts following due process.

-

Support the evaluation with sufficient documented evidence.

-

Present a written assessment about the effectiveness of

the company’s internal control as of the end of

the most recent fiscal year.

Management

must perform procedures sufficient to support its evaluation

of control effectiveness, and is prohibited by Standard

2 from using the auditor’s testing as part of the

basis for its assessment of control effectiveness. Management’s

failure to fulfill the foregoing responsibilities requires

the auditor to disclaim an opinion on internal control due

to a scope limitation.

Auditor’s

responsibilities. Standard 2 requires the

auditor to do the following:

-

Understand and evaluate management’s process for

assessing the effectiveness of the company’s internal

control over financial reporting.

-

Plan and conduct an audit of the company’s internal

control.

-

Based on this audit, provide an opinion on management’s

written assessment about the effectiveness of the company’s

internal control.

This

opinion incorporates the auditor’s opinion on the

effectiveness of the company’s internal control over

financial reporting.

These

responsibilities augment those required for the financial

statement audit.

Included

Entities

In

general, the scope of the audit of internal control includes

all entities over which management has the ability to affect

internal control:

-

Entities acquired on or before the date of management’s

assessment as of the end of the fiscal year, including

consolidated entities or those proportionately consolidated;

and

-

Those accounted for as discontinued operations at the

end of the fiscal year.

In

some situations, such as when management does not have the

ability to affect the controls of an equity method investee,

the auditor’s scope includes only the controls related

to the investor’s financial reporting of its interest

in the investee, rather than the controls in place at the

investee. The applicable controls are those designed to

ensure proper application of the equity method in reporting

the company’s proportion of investee income or loss,

the investment balance, adjustments, and disclosures. Variable

interest entities (VIE), defined in FASB Interpretation

46, are treated in a similar fashion when management is

not the primary beneficiary and does not consolidate the

VIE. Importantly,

the auditor must evaluate the reasonableness of management’s

claims regarding its inability to affect controls at such

entities.

Selecting

Locations for Testing

In

a multilocation environment, the auditor must decide where

to focus control testing, typically by evaluating the set

of locations and selecting a subset that offers an optimal

combination of effectiveness and efficiency. Standard 2

recommends the following approach:

-

Identify business units or locations that are individually

important.

- Identify

locations having specific risks. For example, financial

trading firms are susceptible to counterparty risk. If

the client concentrates a large number of forward contracts

in a small number of institutions, failure of these institutions

could lead to significant losses that may result in material

errors, fraud, and other reporting improprieties.

-

When, in the aggregate, the remaining locations are insignificant,

no further action is required.

-

If the remaining locations are significant when aggregated,

the auditor should examine company-level controls over

this group by checking documentation and testing these

controls.

Company-level

controls include those thought of as “general”

or “disciplinary”—

-

those pertaining to the control environment, such as the

“tone” set by management;

-

the internal audit function;

-

supervisory controls to monitor operations;

-

the risk assessment process; and

-

controls over the process related to period-end reporting.

When

the auditor cannot evaluate the effectiveness of company-wide

controls without site visits, locations should be selected

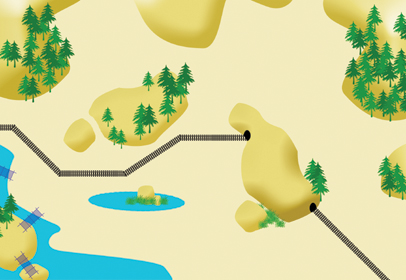

for testing. The Exhibit

summarizes the preceding approach.

Design

Versus Operating Effectiveness

Whereas

design effectiveness pertains to whether a control is properly

crafted, operating effectiveness deals with use of a properly

designed control to prevent, detect, or correct misstatements

or irregularities on a timely basis. For example, a daily

reconciliation of cash receipts is not effectively designed

when the cashier performs the reconciliation. But if an

independent person is designated to perform the reconciliation

and the other procedures are properly documented, the control

is effectively designed. The control is not operating effectively

when the independent reconciler either fails to perform

the reconciliation daily or does so in a perfunctory manner.

Design effectiveness of this control could be tested by

reviewing documentation to ensure that the procedures are

satisfactory. Operating effectiveness could be tested by

examining the reconciler’s initials on the daily reconciliation

sheet.

The

“as of” Date

A striking

difference between a financial statement and an internal

control audit relates to the opportunity to correct deficiencies.

Whereas a company can correct material misstatements detected

during a financial statement audit by accepting the auditor’s

proposed adjustments, if the auditor detects a material

control weakness, it may not be possible to fix it in time.

Because the auditor’s opinion is “as of”

the balance sheet date, the auditor must issue an adverse

opinion on internal control when material weaknesses exist,

even when the company receives an unqualified opinion on

the financial statements.

Material weaknesses can be corrected when caught in time.

Management

must correct the control system at such a time that the

auditor has sufficient time to test the modified controls.

Accordingly, the auditor should begin the control audit

to leave enough time for corrections.

Standard

2 indicates that the auditor’s opinion on internal

control relates both to a point in time and taken as a whole:

To

express an opinion on internal control over financial reporting

effectiveness as of a point in time, the auditor

should obtain evidence that internal control over financial

reporting has operated effectively for a sufficient period

of time, which may be less than the entire period (ordinarily

one year) covered by the company’s financial statements.

To express an opinion on internal control over financial

reporting effectiveness taken as a whole, the auditor

must obtain evidence about the effectiveness of controls

over all relevant assertions related to all significant

accounts and disclosures in the financial statements. This

requires that the auditor test the design and operating

effectiveness of controls he or she ordinarily would not

test if expressing an opinion only on the financial statements.

Taken

as a whole. The auditor exercises judgment

to ascertain those accounts considered “significant”

or more than material. The auditor also considers qualitative

characteristics. For example, investment balances not material

to the overall financial statements may obscure the true

nature of the relationship, especially when the investment

is in partially consolidated entities or involves debt guarantees.

And certain accounts that are liquid or incorporate significant

estimates are riskier than others. Examples include cash,

marketable securities, and warranty liabilities.

Point

in time. Internal control procedures can relate

to either transaction flows or account balances, sometimes

referred to as “stocks.” Examples of controls

relating to transaction flows include approving cash disbursements;

prelisting cash receipts; approving credit sales; and matching

purchase orders, vendor invoices, and receiving reports

when booking accounts payable. Controls over balances (stocks)

include periodic reconciliation of bank accounts; reconciliation

of subsidiary ledgers with control accounts; procedures

for physical inventory counts; and controls governing the

periodic preparation of financial statements. Overarching

controls include the factors comprising the control environment.

Overarching controls and those pertaining to flows operate

continuously throughout the fiscal period; controls relating

to balances typically operate less frequently. Thus bank

accounts are reconciled monthly, whereas controls over cash

flows are continuous.

Timing

considerations. Controls must operate for

a long enough period, which need not be an entire fiscal

year, to provide sufficient confidence in the auditor’s

control tests. Accordingly, the auditor must make several

observations of controls that operate only at a point in

time. Controls

that operate infrequently should be tested closer to the

“as of” date. These include controls over: the

periodic preparation of financial statements; individual

account balances; and nonroutine transactions. Consider

a calendar-year company that begins the procedure of reconciling

the accounts-receivable subsidiary ledger to the control

account only at the end of December. The auditor might conclude

that one observation is not sufficient to evaluate this

control’s operating effectiveness.

These

considerations suggest that an unqualified opinion on internal

control should state: “The controls were effective

for a sufficient period of time during the fiscal year to

be able to support the conclusion that they were still effective

at the end of the period.” Nevertheless, Standard

2 calls for expressing an opinion as of a point in time,

the end of the fiscal year.

Extent

of Testing

PCAOB

Standard 2 requires the auditor to obtain evidence of the

effectiveness of controls pertaining to all relevant assertions

for all significant accounts each year; each year must stand

on its own. It also calls for the auditor to vary the nature,

extent, and timing of testing from year to year to introduce

unpredictability and to respond to changing circumstances.

Examples of variations include changing the number of tests

performed and adjusting the combination of testing procedures.

How

much testing? The auditor should generally

perform sufficient testing to obtain a very high level of

confidence, in the range of 95% to 99%, that the controls

can prevent, detect, or correct material misstatements in

any particular assertion. Many control procedures are difficult

to quantify, however. Procedures such as approvals and reconciliations

typically leave a documentary trail. On the other hand,

because many controls involving segregation of functions

and control environment factors, such as management’s

philosophy and operating style, provide no documentary evidence

of the control’s performance, the auditor should subjectively

assess the probability of effectiveness.

The

results of substantive testing provide another opportunity

for assessing the effectiveness of controls. For example,

if the auditor uncovers a previously unnoticed material

misstatement of credit sales, then the auditor could easily

conclude that controls over credit sales are ineffective,

and decide that a material weakness exists requiring an

adverse opinion on internal control. Even nonmaterial misstatements

can signal ineffective controls.

Rotation

of testing. Although Standard 2 precludes

the rotation of testing over several fiscal periods, reduced

testing seems reasonable when conditions have not changed

significantly and controls are unaltered from one period

to the next. For example, assume that extensive testing

was conducted on controls over inventories in fiscal year

2004. If in 2005, tests to obtain an understanding of these

controls indicate no significant changes, a company might

reasonably decide to reduce testing of controls over inventories

in 2005.

Using

the Work of Others

An

auditor may use the work of competent client personnel,

as long as the auditor’s own work is the “principal

evidence” supporting the opinion. Principal evidence

should not be interpreted in a purely quantitative manner,

as the auditor may be able to rely extensively on certain

tests performed by client personnel but place little reliance

on other tests.

The

following considerations should be kept in mind when relying

on the work of others:

-

The greater the materiality of and the degree of judgment

and estimations inherent in an account, the less the auditor

should rely on client testing. Conversely, the auditor

could rely on the testing of routine accounts requiring

low-level judgments.

- The

more pervasive the control and the higher the degree of

judgment involved in evaluating a control’s effectiveness,

the more the auditor should rely on her own testing. For

example, reviewing control environment factors requires

an auditor’s own tests, because of the qualitative

nature of these controls. Extensive reliance could be

placed on the client’s testing of more-routine controls,

such as reconciliations, document matching, and programmed

validity and logic checks.

- Where

the potential for management override is substantial,

the auditor should place little reliance on client testing.

Evaluating

Weaknesses

To

formulate an opinion on internal control, the auditor needs

to evaluate all the evidence obtained, including that obtained

while conducting the financial statement audit. An unqualified

opinion is appropriate only in the absence of material weaknesses.

According

to Standard 2, an internal control deficiency exists when

the design or operation of a control does not allow for

the timely prevention or detection of misstatements. It

defines a significant deficiency as one that affects the

company’s ability to reliably process and report financial

data such that there is more than a remote likelihood that

the financial statements will be impacted in a manner that

is consequential but not material. For example, suppose

a company does not reconcile its intercompany transactions.

If the auditor expects the impact of any misstatement to

be significant but not material, the control weakness would

be considered a “significant deficiency.”

Standard

2 defines a material weakness as “a significant deficiency,

or combination of significant deficiencies, that results

in more than a remote likelihood that a material misstatement

of the annual or interim financial statements will not be

prevented or detected.” Identifying material weaknesses

requires the auditor to examine identified deficiencies

to determine whether any should be classified as “significant

deficiencies,” and to consider whether any of the

significant deficiencies are “material weaknesses.”

Evaluating

Deficiencies

Considerable

professional judgment is required when assessing the significance

of a deficiency, including the auditor’s consideration

of the following:

-

The potential for a misstatement, rather than whether

a misstatement has actually occurred;

-

The impact of a deficiency, including the amounts of transactions

exposed and the volume of transactions in the affected

accounts;

-

How the interaction of controls with other controls, their

interdependence with other controls, and control redundancies

affects their proper functioning.

To

illustrate control interdependence and redundancies, consider

an example where a storeroom clerk keeps the perpetual inventory

records and takes the annual physical count. Although this

weakness could be considered material, redundant controls

reduce the risk. If the clerk is on one of several teams

using established procedures, such as properly supervised

counts, the control weakness is mitigated and would not

typically be considered a material weakness.

Material

Weaknesses Versus Significant Deficiencies

Differentiating

a significant deficiency from a material weakness is subjective.

The distinguishing characteristic of a material weakness

is the existence of “more than a remote likelihood”

that a material misstatement will not be prevented or detected.

Although several examples in Appendix D of Standard 2 illustrate

that distinction, determining just what constitutes a material

weakness is difficult.

Although

no definition of the term “remote” is offered

in the standard, a practical approach to evaluating weaknesses

consists of the following steps:

-

Estimate the monetary effect of each weakness uncovered.

-

Assign a “material misstatement likelihood factor”

to each weakness—for example, remote, reasonably

possible, or probable—similar to the labels found

in SFAS 5, Accounting for Contingencies.

-

Rank all weaknesses on the material misstatement likelihood

factor.

-

Denote all weaknesses with more than a remote likelihood

as “material weaknesses.”

-

Determine the significance of the remaining deficiencies

by reviewing the estimated monetary impact of each.

-

Examine those deficiencies designated “significant”

to decide whether a combination thereof constitutes a

material weakness.

Audit

Reports

Standard

2 specifies the content of the report on internal control.

Auditors should be aware of several factors:

-

An auditor may provide either separate or combined reports

on the financial statements and internal control.

-

Whereas the opinion on the financial statements typically

addresses multiple periods, the opinion on internal control

covers only the most recent fiscal year.

-

When an auditor issues separate reports, the annual report

must contain both.

-

The reports should have the same date, normally the last

day of fieldwork.

-

An auditor’s report on management’s assessment

of internal control over financial reporting includes

an opinion on the company’s internal control.

Report

Modifications

The

following situations call for the auditor to modify the

“clean opinion” report:

-

Inadequate management assessment or inappropriate

management report. If an auditor concludes that management’s

process for assessing internal control is inadequate,

the auditor should modify the opinion for a scope limitation,

which could result in a qualified opinion, a disclaimer

of opinion, or withdrawal from the engagement. When management’s

report is inappropriate, an auditor should include an

explanatory paragraph describing the reasons for the inappropriateness.

- A

material weakness exists in the company’s internal

control. In this case, an auditor must render an

adverse opinion on the effectiveness of internal control.

An auditor may, in the same report, render an unqualified

opinion on management’s assessment if it also concludes

that internal control is not effective.

-

Management or circumstances restrict the scope of

the engagement. When management imposes restrictions,

an auditor should withdraw from the engagement or disclaim

an opinion on both management’s assessment and the

effectiveness of internal control.

-

The auditor’s report relies in part on the report

of another auditor.

-

A significant subsequent event occurred after the

“as of” date.

-

Management’s assessment contains additional

information. New information could concern corrective

action taken after management’s assessment, or indicate

plans to implement new controls. The auditor should disclaim

an opinion on the new information.

When

the auditor issues an unqualified opinion on the financial

statements but an adverse opinion on internal control, due

to one or more material weaknesses, the report should indicate

that the conduct of the financial statement audit took those

material weaknesses into account. This information helps

readers of the financial statements understand why the auditor

gave an unqualified opinion on the financial statements.

The auditor should include similar language when the adverse

opinion on internal control affects the opinion on the financial

statements.

Most

Likely Reasons for Opinion Modifications

As

a practical matter, opinion modifications are likely to

arise from three circumstances:

-

Material misstatements detected by the auditor were not

identified by the company. This situation could result

in an adverse opinion.

-

Inadequate documentation. This situation is a control

deficiency that may constitute a material weakness if

extensive. In this case, the auditor renders an adverse

opinion.

-

Inadequate management assessment creates a scope limitation

requiring a disclaimer, a qualified opinion on internal

control, or withdrawal from the engagement.

Because

it requires the auditor to go well beyond the review and

evaluation of controls that was the norm for reporting on

financial statements, Standard 2 promises to fundamentally

alter both the control systems in public companies and auditors’

assessment of them, thereby providing additional assurance

to users.

Jack

W. Paul, PhD, CPA, is a professor of accounting at

Lehigh University, Bethlehem, Penn. |