|

Evolving

Regulations and Oversight in the Public Interest

An

Interview with SEC Chief Accountant Donald T. Nicolaisen

By

Robert H. Colson

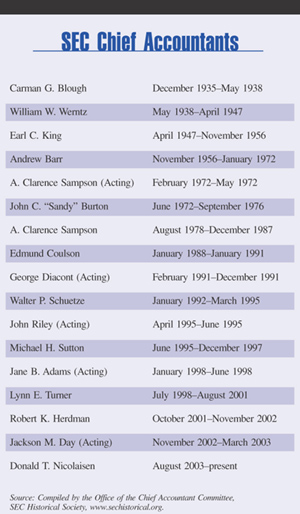

SEC

Chairman William H. Donaldson announced the appointment

of Donald T. Nicolaisen, CPA, as the commission’s

chief accountant in August 2003. Nicolaisen oversees the

SEC’s accounting policy initiatives and leads its

efforts with national and international standards setters

on critical accounting and auditing issues. He also works

closely with the Public Company Accounting Oversight Board

(PCAOB) to ensure that auditors adhere to the highest business

and ethical standards.

Nicolaisen

was previously a senior partner at Pricewaterhouse- Coopers

LLP, where he held a range of management and leadership

positions after joining the firm’s predecessor, Price

Waterhouse, in 1967. From 1988 to 1994, he led Price Waterhouse’s

national office for accounting and SEC services. During

that time, he was also a member of FASB’s Emerging

Issues Task Force (EITF).

Nicolaisen

met with CPA Journal Editor-in-Chief Robert Colson at the

SEC’s Washington, D.C., office in late 2003.

The Role of the Chief Accountant

The

CPA Journal: What is the dominant item on your agenda as

the new chief accountant?

Donald T. Nicolaisen: Narrowing it down to

one thing is difficult, but broadly, it’s helping

investors be better informed and restoring investor confidence

through reforms that improve the financial reporting process.

This includes reform in the accounting and auditing profession,

which the Sarbanes-Oxley Act has already catalyzed. The

audit process must be improved, and investors deserve financial

statements that are more transparent and easier to understand.

This starts at the top of the organization and will involve,

in many cases, a cultural change. In addition, there is

an expectation gap between what the auditor is required

to do and what the public expects the auditor to do. This

gap needs to be addressed. Auditors must step up to the

plate and better explain their role.

Fortunately,

the OCA [Office of the Chief Accountant] staff comprises

talented people, fully dedicated to quality financial reporting

and investor protection. Together, I am confident that we

will achieve our goals.

CPAJ:

How would you characterize the problems you inherited on

entering the chief accountancy? CPAJ:

How would you characterize the problems you inherited on

entering the chief accountancy?

Nicolaisen: Individual and corporate greed

has strained the system and created excesses and abuses

that have led to unethical and sometimes criminal behavior.

In some cases, excessively detailed accounting rules have

given those who choose to abuse the system a means to achieve

better-looking numbers in financial statements by circumventing

the fundamental principles behind the rules.

The

SEC staff recently released a study on principles-based

accounting standards. The report supports objectives-oriented

standards, which will provide a better framework in which

to exercise professional judgment and may help facilitate

compliance with the intent of the standards. Such a change,

where judgments are required and appropriately exercised,

will go a long way toward improving the corporate reporting

process.

CPAJ:

How do you combat the “parsing the rules” mentality?

Nicolaisen: This is another example of how

our culture has evolved. We have a society of laws and rules,

and people—including business owners—who want

to understand what rules apply to them and how to follow

them, all of which is entirely fair. But problems arise

when the rules are stretched and transactions with little

or no underlying economic substance are entered into simply

to achieve an accounting result. In these cases, people

have crossed the line and have misled investors. Professional

accountants, whether working as preparers or auditors, recognize

that misleading investors is unacceptable, and they have

the ability to contribute to quality financial reporting.

Our challenge, and the accounting profession’s challenge,

is not only to encourage compliance with the rules but also

to inform investors about the underlying transactions and

the resulting financial picture.

One

area where parsing the rules has been especially troubling

is the use of SPEs [special purpose entities]. I believe

that FASB has identified the right approach in FIN 46 [Consolidation

of Variable Interest Entities, effective October 9,

2003] to address the underlying economics of such entities.

Now it’s up to the business community and accounting

professionals to apply their professional judgment and implement

these principles.

CPAJ:

What is the role of the OCA in bringing about reform?

Nicolaisen: My role is to protect investors

and maintain the integrity of our securities markets. OCA

has a number of resources at its disposal to accomplish

these goals. The bully pulpit is one such vehicle, and I

intend to use it effectively. It’s essential that

registrants and accountants understand that we’re

serious about reform. I want to be very clear: We will enforce

the laws and regulations, and people who violate the letter

or spirit should expect to hear from us.

CPAJ:

Has the pattern of registrants or accountants bringing problems

to the OCA changed?

Nicolaisen: Historically,

the chief accountant has had an open dialogue with registrants

and accountants on how to account for difficult transactions,

and I intend to continue that tradition. This approach has

worked well for all parties. But we don’t see all

the transactions we’d like to, although we often see

the extremes, sometimes after the fact. In our experience,

trade and industry groups have done an excellent job communicating

their concerns to us.

I encourage

registrants and auditors to discuss questions with OCA early

in the process, before an issue has escalated into a crisis.

It’s important to understand that we don’t say

“no” to every proposed accounting treatment

brought to our attention. Nonetheless, I would caution that

if the company’s auditor is challenging the accounting,

then we’re also likely to see problems with it. In

short, we’re encouraging a more open dialogue that

begins earlier in the process.

CPAJ:

How do you view the change in the corporate accounting culture

from an objective, scorekeeping function to a profit center?

Nicolaisen: Restoring investor confidence

will require a top-to-bottom cultural change for some entities.

Unfortunately, the profit-center culture exists in some

companies where executives place undue pressure on the accounting

function to find ways to add to the bottom line through

accounting entries rather than expecting the accounting

function to serve as the neutral reporter. Of course, many

CEOs run their businesses in the right way—by supporting

appropriate research and development programs, ensuring

quality manufacturing and distribution, and trying to earn

an honest return for their shareholders—and treat

the accounting function as an objective scorekeeper of their

successes and failures. The CEO and CFO certifications that

Sarbanes-Oxley now requires represent a big step forward,

because officers now have to affirmatively certify that

the financial statements provide an accurate picture of

results. The act of signing one’s name on such a certificate

drives home the fact that the CFO or CEO is personally vested

in the financial reporting process.

CPAJ:

What are your thoughts about the differences between the

responsibility of officers and directors for financial statements

and that of independent auditors?

Nicolaisen: Quality financial reporting starts

with officers and directors. When public company CEOs, CFOs,

audit committees, and boards set a tone at the top that

respects and supports the integrity of the financial reporting

process, the likelihood of quality communications with investors

increases significantly. That tone at the top, starting

with the CEO managing the business, accepting his or her

stewardship of others’ investments, and the CFO reporting

on the business as a steward of others’ resources,

is vital to the entire process. Section 404 [of the Sarbanes-Oxley

Act] and other certifications will not work unless directors

and officers accept their responsibility and accountability

to investors. CEOs or CFOs who fail in these roles may find

themselves facing SEC enforcement actions. The independent

auditor’s role is to understand and challenge the

accounting and reporting of the company, serving as an objective

evaluator of both compliance and fair presentation.

CPAJ:

Does the chief accountant have different responsibilities

for preparers and auditors?

Nicolaisen: I have high expectation of both,

and, although their roles differ, both groups have a duty

to investors and can significantly contribute to quality

financial reporting. OCA is at the hub of lots of activity

within the SEC, much of which includes the preparer community.

We also advance the Commission’s interests with the

Public Company Accounting Oversight Board [PCAOB], FASB,

IASB, and others in the international arena. FASB sets GAAP

for preparers, and the PCAOB standards serve the auditor

community.

The

PCAOB is a brand-new organization, for which the SEC has

oversight responsibility, as it does for FASB. As a practical

matter, the SEC coordinates its oversight of both organizations

through OCA. The PCAOB, under Chairman Bill McDonough’s

leadership, has it exactly right: It will hold firms and

individuals to the highest level of professional and ethical

standards. Enhancing the audit process and ensuring that

firms are independent in fact and appearance is extremely

important.

The

SEC is a strong advocate of the PCAOB inspection process,

which compares what firms say to what they do. We also have

experience with how registrants interpret and use accounting

principles, and we share that experience with FASB as it

strives to improve the principles underlying financial reporting.

Also, we work closely with the SEC’s Division of Corporation

Finance [Corpfin] in certain areas as it reviews registrants’

filings and issues comment letters, as well as with the

Enforcement Division on actions concerning both accounting

(preparer) and auditing issues.

Ethics

and Independence

CPAJ:

CPAs’ ethics require them to follow FASB standards

in financial reporting. Should non-CPA CFOs and controllers

adopt similar ethics?

Nicolaisen: Yes. While Sarbanes-Oxley requires

CFOs to adopt ethical standards, it does not require any

specific standard or SEC approval of such a standard. It

will be interesting to see if CFOs, whether or not they

are CPAs, voluntarily adopt such rigorous standards. I think

it would be a very good thing for associations that represent

financial officers to address this in their codes of ethics,

and I would not anticipate different standards for CPAs

and non-CPAs.

CPAJ:

You talked about “tone at the top” at public

companies. What’s the appropriate tone at the top

for accounting firms?

Nicolaisen: OCA encourages firms to approach

client acceptance and retention with selectivity, retaining

those companies as audit clients that are consistent with

their ethical expectations. Senior management at the firms

sets the standards and values of their respective organizations.

For example, compensation plans are a tangible measure of

a firm’s values. If a firm doesn’t support audit

partners making tough calls and replaces them with partners

who are more accommodating, that practice will damage this

profession and the firm along with it.

The

director of the Enforcement Division, Steve Cutler, has

made it clear that the SEC considers individual as well

as firm accountability. Having the PCAOB inspection as part

of the process will help immensely in understanding the

tone at the top. The PCAOB’s inspectors are asking

auditors about the level of support they receive from their

firm when they make tough decisions. In cases where appropriate

support has been lacking, you can expect PCAOB action with

the full support of the SEC.

CPAJ:

How do you deal with registrants who come to you with accounting

questions? For gray-area questions, would you tell them

specifically what to do? Alternatively, would you explain

your view of what they should consider but leave the decision

to them?

Nicolaisen: Our starting point is to consider

what’s best for the investor, and how to make the

economics of the transaction as transparent as possible

to investors. I’d want to understand the economics

of the transaction and whether the proposed accounting is

consistent with the economics. Normally, after considering

the views of the preparer, its audit committee, and the

preparer’s auditor, my staff would express its views

regarding the appropriate treatment.

Of

course, when someone brings in a question that doesn’t

fall in a gray area, the process is shorter because I don’t

hesitate to say “yes” or “no” as

appropriate. For example, transactions that lack economic

substance and that appear to have been entered into only

to achieve an accounting result would lead to a simple “no”

response.

CPAJ:

The code of professional conduct positions CPAs as objective

neutrals, without primary allegiance to a specific interest,

such as management, investors, or creditors. Yet the public

expects that CPAs represent third-party users when performing

services where such users are inherent to the engagement.

Should CPAs formally address this in the code of conduct?

Nicolaisen: Without parsing words, it seems

to me that every set of audited financial statements has

a third-party user, either immediately or eventually. Having

a code of conduct that made it clear that CPAs are the users’

watchdog would have certain legal implications, but, nevertheless,

it would be a good thing. Preparers and management have

a tremendous information advantage over users. OCA’s

stance on Management’s Discussion and Analysis of

Financial Condition and Results of Operations [MD&A]

is clear: We want management to share with investors their

views about the business. The auditor can help management

in identifying appropriate disclosures.

In

any event, our markets work on the underlying assumption

that the auditor’s primary responsibility is to the

investor. Increasing awareness of this perspective would

also make the CPA profession more attractive to young people.

I understand that there is a resurgence of interest on campuses

in accounting precisely because young people are attracted

by the importance of auditors’ work in our capital

markets and by the ethical dimension inherent in being an

accountant.

CPAJ:

How can we increase ethics awareness among CPAs?

Nicolaisen: My experience has been that you

really learn something well when it’s part of your

work responsibilities and especially when you teach it to

someone else. Teaching ethics within the firm, or mentoring

young people in ethics, is one way for senior-level professionals

to retain ethical considerations in the forefront. Evaluating

individuals on their participation in such a mentoring program

would also increase its importance. Firms should reward

partners and staff for taking tough stands and doing the

right thing. Prompt disciplinary action can help as well.

CPAJ:

What are your reactions to the concerns that new audit requirements,

such as the forensic tone of SAS 99 [Consideration of Fraud

in a Financial Statement Audit], could work against the

free flow of information between client and auditor?

Nicolaisen: SAS 99 could alter the tone of

the relationship between some auditors and their clients,

but it would be for the better if the result is that the

auditor is more objective, more neutral, and more discerning

about internal control and the risks of financial statement

fraud. In too many cases, auditors failed to respond critically

to inappropriate actions of their clients. The auditor’s

primary job is to remain independent in fact and appearance

and not to get “cozy” with the client. In turn,

I would expect that clients, whether private or public,

want auditors to be as tough as possible on the basics because

toughness gives their financial statements that much more

credibility. The job of the auditor is to be honest, sometimes

brutally honest, with company management. An auditor shouldn’t

be capricious or belligerent; a thoughtful, independent,

critical, and professional auditor, however, is very valuable.

If you’re going to be an auditor of a public company,

you have to place auditing and its culture first in all

things and forgo the role of advocate.

Finally,

the auditor should bring issues to management and the audit

committee early in the process. An auditor fails in some

sense when management is surprised—often at the last

minute—by breaches of internal control or low-quality

financial statements.

Independence

and the PCAOB

CPAJ:

What is the most important consideration when considering

auditor independence?

Nicolaisen: In my mind, the appearance of

independence is critical. Whenever there is a potential

for a conflict of interest caused by the appearance of a

lack of independence, Sarbanes-Oxley provides a mechanism

for the audit committee to determine whether the service

should be performed or whether the auditor has compromised

his or her independence. Because the appearance of independence

is so important, auditors should disclose and discuss with

the audit committee not only services that management wants

them to perform, but also other relationships that might

arise during the ordinary course of business, such as leases

of office space or purchases of products or services.

Independence

is a difficult area, and one that will receive lots of attention

from this office and the PCAOB. Because specific facts vary,

Sarbanes-Oxley calls for full disclosure to the audit committee

and requires the audit committee to reach a conclusion.

CPAJ:

What is your response to the SEC’s final rules on

auditors and tax services? Is the identification of permitted

services clear enough to keep auditors from becoming advocates

in this arena?

Nicolaisen: Sarbanes-Oxley permits independent

auditors to provide tax services to their audit clients

if such services are preapproved by the audit committee.

Auditors do need tax expertise, and they need to understand

the tax process in order to adequately audit a company’s

tax liabilities and uncertainties. But there are some services

for which the audit committee should be especially probing.

A recent Senate staff report analyzed several cases where

the auditor sold highly structured, highly complex, and

highly aggressive tax products to companies for significant

fees. Other audit committees have identified similar “products”

being “sold” to executives of the independent

auditor’s client. I believe that these types of services

are not consistent with either Congressional intent embodied

in the act or with the appearance of independence on the

part of the auditor.

For

example, I think it’s appropriate for auditors that

are also involved in tax-return preparation to explain to

their clients how they will treat certain transactions for

tax purposes, and to suggest legitimate tax strategies,

such as that the client should consider accelerated depreciation

rather than straight-line. But that kind of advice is very

different from the design of complicated, sophisticated

tax shelters that involve attorneys, investment bankers,

and auditors, often at fees significantly above hourly scales.

Auditors, in my view, should not participate in those types

of activities.

CPAJ:

How does the OCA participate in the SEC’s oversight

of PCAOB rule making?

Nicolaisen: The PCAOB discusses with OCA where

it’s headed with a standard before their board votes

to release it, and communication between the PCAOB and OCA

is appropriate. OCA’s experience base provides us

and the PCAOB with a useful perspective on how to achieve

the PCAOB’s goals. Our expectation is that OCA and

the PCAOB staffs’ positions will be reasonably close

before the PCAOB staff takes a proposal to their board.

Of course, their board and staff can always make changes,

but if the process works properly, there won’t be

any occasions when the chief accountant is unable to recommend

that the SEC adopt a PCAOB rule.

To

date our relationship has worked very well. Under the leadership

of Bill McDonough, the PCAOB has done a tremendous amount

of work on a tight timeframe, including hiring staff, registering

U.S. public accounting firms, promulgating a number of important

standards, and engaging in a limited inspection of the large

firms.

CPAJ:

Would you explain the process, using the PCAOB’s section

404 attestation proposal as an example?

Nicolaisen: OCA has read the public comment

letters on the proposed rule and discussed the concerns

raised and views expressed with SEC and PCAOB staff. We

consider these comments very carefully, and I encourage

interested parties to participate in this process. In the

end, I believe the PCAOB will produce a standard that appropriately

considers all input and addresses this difficult issue.

The objective of reporting on internal controls has been

discussed as long as I’ve been a member of this profession,

so I’m excited to finally see it become a reality,

and I’m confident that the investor will benefit from

this requirement.

CPAJ:

Describe your take on the differences of opinion regarding

the extent of substantive testing as part of the auditor’s

attestation on internal control.

Nicolaisen: The current debate and discussion

on the extent of auditor involvement in internal control

attestations has been healthy and useful. The PCAOB did

an excellent job issuing a proposal that would generate

the appropriate level of discussion regarding their views.

Many comment letters expressed concern with cost, and many

suggestions were offered as to how the independent auditor

might obtain satisfaction in a cost-effective manner. I

agree with the view of the PCAOB that the auditor has to

understand and test the effectiveness of controls, and I

believe the final PCAOB standard will strike an appropriate

balance.

CPAJ:

What does the SEC plan to do when companies self-assess

as having a material weakness in internal control, and the

auditor concurs?

Nicolaisen: We’ve been discussing that

issue quite a bit. I believe that the commission will accept

internal control assessments with material weaknesses as

long as the audit opinion on the financial statements is

unqualified. We don’t want a situation where rendering

a negative opinion on internal control would by itself preclude

a company from participating in our markets. The principal

objective is to inform investors. The marketplace will decide

what it means if there is a material weakness in internal

control but the auditor’s opinion on the financial

statements is unqualified.

CPAJ:

How would an auditor evaluate the audit committee on internal

control?

Nicolaisen: I think for the auditor to grade

an audit committee, using A, B, or C, would be a bad idea

and would place the auditor in an awkward position. But

in implementing Sarbanes-Oxley and in considering the important

role of the audit committee, it’s hard to envision

how an evaluation of internal control would be complete

without considering the audit committee’s activities,

objectivity, and performance. There are many strong audit

committees, and I am confident that they will continue to

improve over time, in part because they will feel increasing

pressure to represent shareholders’ interests, which

include the need for complete and accurate reporting.

Looking

Forward

CPAJ:

What’s your take on the future of the accounting profession?

Nicolaisen: In light of the recent financial

scandals, no one could claim that the auditor is irrelevant,

and the investing public and Congress have made it clear

that they value good financial reporting and high-quality

audits. To me, that translates into an expectation that

accounting and auditing should have a bright future. Many

changes under way will affect CPAs and the profession, and

that is especially true at the audit firm level.

The

audit firms’ near-term adjustments to the challenges

of finding the right people and developing the right expertise

to perform financial statement audits and internal control

attestations as envisioned by Sarbanes-Oxley will determine

whether accounting will be an exciting, growth profession.

From what I see now, the road may be a little bumpy, but

I am confident that the accounting and auditing profession

will emerge stronger, more independent, and that it will

offer a more rewarding career to young people who are considering

entering the profession.

CPAJ:

What’s the role of the AICPA in the world after Sarbanes-Oxley?

Nicolaisen: The AICPA’s role has changed,

but it is a strong organization with tremendous talent and

resources. I would caution, however, that whatever role

it chooses to take in the future should not be confusing

to the public—the AICPA is no longer a regulator or

a standard setter for public company audits, and self-regulation

of those who audit public companies is a thing of the past.

However, regulation and standards setting for public company

audits aside, the AICPA has a tremendously important role

to play in training, education, supporting its members and

the rest of the profession, and representing the face of

the profession to its many constituencies. Its role with

respect to private companies is significant.

I would

love to see the AICPA do even more in the educational area,

such as creating and distributing material like its recent

Audit Committee Toolkit. Such publications are extremely

valuable, serve the public good, and create positive impressions

of the CPA profession. The AICPA also has an important role

to play in supporting other institutions in the accounting

profession, such as the PCAOB and FASB. Working together,

the future of the accounting profession is bright.

CPAJ:

Is the AICPA’s restructuring of the Auditing Standards

Board, to set audit standards for the private sector, helpful?

Nicolaisen: It’s too early to tell,

but I would hope that differences in auditing standards

would be minimal. From my perspective, substantially different

auditing and accounting standards for public and private

companies could be confusing and potentially counterproductive.

The PCAOB process is deliberate, open, and independent;

as a result, I would expect that the marketplace and investors

will gain confidence in their standards and that they will

be the standards most familiar to the investing public.

While the AICPA does set standards for private companies,

every bifurcation of audit standards has the potential to

confuse the public and investors about what CPAs do. Accordingly,

I would encourage cooperation between the AICPA and PCAOB.

CPAJ:

Is it time for more consistent regulation of CPAs at the

state level?

Nicolaisen: I suspect that what state a CPA’s

license is in makes very little difference to the investing

public. Investors are looking for the assurance of a CPA’s

report on an audit of financial statements. The difference

in licensing requirements across the states does add complications,

and the Uniform Accountancy Act [UAA] hasn’t worked

well enough to encourage licensing authorities to pursue

that route.

On

one hand, it’s in the best interest of the investing

public to have uniform, national qualifications for CPA

licensure; on the other hand, the states clearly have an

interest in licensing professionals who practice within

their borders. Although, at the state level, passage of

a uniform law hasn’t worked, we’re at a unique

juncture in the history of the CPA profession. Thus,

it may be possible that an arrangement could be made that

would preserve the states’ legitimate interest in

licensure while serving the national interest as it relates

to CPAs’ importance to the investing public. This

is a good issue for the NYSSCPA and other state societies

to consider.

Robert

H. Colson, PhD, CPA, is Editor-in-Chief of The CPA

Journal. |