RESPONSIBILITIES & LEADERSHIP

Career Paths

Fellowship Opportunities

at the SEC and FASB

By Stephen A. Kolenda

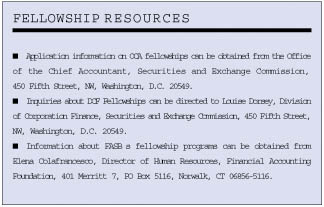

Several temporary professional opportunities are available with leading accounting standards-setting organizations and regulators. These positions—including ones at the Securities and Exchange Commission (SEC)and the Financial Accounting Standards Board (FASB)—average two years in duration, and offer opportunities for accounting professionals and academics to step away from their normal career path.

Fellowship Background

During

1998, this author took such a step and served as the first Professional Academic

Fellow in the SEC’s Division of Corporation Finance (DCF). This fellowship

was created as an alternative to the Professional Academic Fellow program

in the SEC’s Office of the Chief Accountant (OCA). Other accounting

fellowships at the SEC are available for public accountants. Similar exciting

opportunities exist at leading organizations, such as FASB and the International

Accounting Standards Board (IASB), for accountants from public accounting,

industry, and academia.

During

1998, this author took such a step and served as the first Professional Academic

Fellow in the SEC’s Division of Corporation Finance (DCF). This fellowship

was created as an alternative to the Professional Academic Fellow program

in the SEC’s Office of the Chief Accountant (OCA). Other accounting

fellowships at the SEC are available for public accountants. Similar exciting

opportunities exist at leading organizations, such as FASB and the International

Accounting Standards Board (IASB), for accountants from public accounting,

industry, and academia.

The OCA staff advises the SEC’s Chief Accountant and Commissioners on current and developing accounting and auditing standards. As such, OCA fellows generally provide the permanent OCA staff with expertise and research on economics, securities markets, and emerging accounting issues. Begun in 1972, there are now up to 10 available Professional Accounting Fellowships in OCA, as well as one Professional Academic Fellowship.

The Professional Accounting Fellowships are nonrenewable two-year terms and are designed for public accountants to spend time working at the highest levels of accounting regulation. Typical candidates are CPAs with at least nine years’ auditing experience. SEC reporting experience is an obvious prerequisite; most recent appointees have been Big Four senior managers. The application includes a 10-to-12-page essay on a current accounting or auditing issue; recently suggested topics included financial instruments, fair value accounting, revenue recognition, principles-based accounting, and implementation of the Sarbanes-Oxley Act of 2002.

The SEC’s Professional Academic Fellowship in OCA is usually filled by a well-respected academic, currently Kimberly Smith from the college of William and Mary (Andy Bailey from the University of Illinois and Paul Munter from the University of Miami are recent academic fellows). The academic fellow serves primarily as a research resource for the OCA staff, normally for a one-year term beginning each August, and works on ongoing rule-making projects, liaises with professional accounting standards-setting bodies, and consults with registrants on accounting and reporting matters.

As a non-PhD with limited interest in pure research, I was looking for an experience different from what OCA could offer. After working in public accounting and SEC compliance for a number of years, I have taught for the past 20 years. The focus of my school and academic career has always been on undergraduate teaching. Preparing students for productive entry-level accounting careers demands bringing new and developing issues to the classroom; in the past, I was able to enliven and enrich classes with material drawn from my own professional experience. Over time, my experience seemed dated. My classes began to revert to combining technical information with increasingly less relevant personal experience, and I relied more on stories from the press and drawn from other professionals’ experiences. In considering this during my last sabbatical, I decided to recharge my knowledge with current hands-on experience that would enliven my teaching.

My discussions with a previous SEC OCA Professional Academic Fellow led me to conclude that my interests and background were not compatible with the needs of such a research-oriented position. Most of the roll-up-your-sleeves compliance work is done at the SEC’s Division of Corporation Finance. DCF’s staff—approximately 100 lawyers and 100 accountants—continually reviews registrants’ periodic and special filings (such as 10-Ks and IPO registrations, respectively). New accounting issues are often first discovered here, where practical applications are inherent and compliance with current regulations is paramount. I thought I could learn a great deal in this environment about how and what the top corporations were actually doing (or trying to do) in their financial reporting.

There have been, and still are, Professional Accounting Fellowships available at the DCF for two-year nonrenewable terms. Eligible candidates must have a CPA, three to nine years’ auditing experience in a public accounting firm, and be familiar with SEC reporting requirements. Appointees sever ties with their current employer and work full-time in Washington, D.C., at competitive salaries.

A First-Time Fellowship

Ultimately, I developed the first DCF Professional Academic Fellowship with Robert A. Bayless, former DCF Chief Accountant, and his staff. I had some idea of what I would experience, but we needed to structure what the SEC would be getting in return (other than the satisfaction of indirectly contributing to accounting education). It was agreed that I would produce two series of seminars—one for the SEC staff accountants and another for its lawyers. In addition, I served as a general resource to the Chief Accountant on special topics and temporary teams. For example, I researched the various—and “creative”— revenue recognition policies being used in a particular industry, then made a recommendation for an authoritative, and less creative, standard the DCF staff could apply. On another occasion, we wrestled with the proper accounting adjustments for the effect on deferred tax asset valuation accounts, in situations where the discount rate changed retroactively during the initial adoption of pension accounting. Dealing with many such current and practical accounting issues contributed to making the fellowship a valuable educational experience.

The initial time with the SEC is spent intensely updating technical knowledge of compliance regulations. The wide and detailed array of rules, forms, and procedures requires a focused effort to renew familiarity to even a basic level. Fellows are assisted by permanent staff in this process—first doing parallel reviews of a registrant’s filing, and later joining review teams on other filings. As agreed, I simultaneously developed and delivered a series of seminars for the staff attorneys. They often had little technical background on the accounting aspects included in a registrant’s filings, and desired a greater understanding of the financial information they were seeing. These sessions were well attended (usually 50–75 staff members) and covered basic financial reports, standards setting, financial analysis, and special topics.

I did a similar series for the accountants that explored controversial and complex accounting issues, such as one on Nonmonetary Transactions and another on Restructuring Charges. Some topics were familiar to me from my teaching and experience, for example, foreign currency transactions; others, such as asset impairments, I needed to research thoroughly before delivering a seminar. Each session provided the attendees with material for further reading, and included many SEC filing examples gleaned from the depths of its EDGAR database. In addition, most seminars were videotaped for future SEC training use. Evaluations indicated that all the seminars were extremely well received by the SEC staff. Later fellows have continued this practice.

Leading the seminars was a valuable experience in itself. I delivered to a very well-educated audience, experienced professionals who demanded immediate and practical relevance. My seminar presentation also identified me as a staff resource, available to help examine specific filing issues as they occurred. The staff often challenged me to consider with them some of the thornier accounting and reporting approaches they were seeking to identify and understand. Additionally, some were intrigued by and learned from the presentation technology and techniques. Several staff give presentations to both other staff and outside organizations; they enlisted my help in polishing their own work.

There were several surprise opportunities that enriched the entire fellowship experience. For example, I was able to sit in on FASB Emerging Issues Task Force (EITF) conference calls; I was also included in meetings with many outside constituent groups while working on Congressionally mandated review of risk disclosure rules for financial instruments. I took part in many other in-house meetings—speeches to staff and public meetings of the Commission, joint meetings with FASB and their staff, and SEC in-house staff training sessions by outside experts or internal SEC staff, on a wide variety of new, controversial, and complex accounting issues. Access to the extensive internal version of EDGAR also afforded me many hours learning about the SEC’s affairs, its staff, and many of its registrant companies.

Other Opportunities

Similar professional fellowships are available at the IASB in London, England, and closer to home at the FASB in Norwalk, Connecticut. FASB offers two versions: Practice Fellowships and Industry Fellowships. Similar to the SEC’s Professional Accounting Fellowships, FASB’s Practice Fellowships draw managerial-level public accountants with a minimum of nine years’ experience. Practice Fellows act as project managers and make recommendations to FASB on technical issues, and develop and draft FASB Statements, Interpretations, Technical Bulletins, and Implementation Guides. They research problems, analyze comments from various FASB constituents, and participate in discussions of FASB and the EITF.

In 1977, FASB developed its unique Industry Fellow Program to bring industry accounting executives’ knowledge and experience into the standards-setting process. Like Practice Fellows, candidates do not apply as they would for the SEC positions; their companies must nominate them. Usually mid-level executives with promising career paths in finance, fellows cut all ties to their former employers to work full-time exclusively for FASB for two years, before their expected return. Industry Fellow responsibilities are similar to those of Practice Fellows, and include opportunities to speak on technical subjects at various conferences (e.g., FEI and IMA). Both FASB Practice and Industry Fellows can have active roles in FASB’s technical inquiry process.

Overall, these fellowships provide a rich and rewarding experience through immersion into the highest levels of corporate financial reporting. Daily requirements to apply the most complex accounting standards and regulations to the reporting of the largest companies in the world are intellectually challenging for any accounting professional. The staff is friendly and professional, and the work environment stimulating. My fellowship has enriched my teaching in many ways. I can now speak to my students of the latest and most complex accounting issues with firsthand experience. I have been involved in the examination of accounting issues, have helped develop new accounting standards, and have seen how companies apply standards or choose not to. In addition to getting a thorough refresher on SEC compliance, fellows see how the government’s regulations are developed and applied to stem abuses of the system of financial reporting upon which the world economy depends. In short, fellowships can provide a completely satisfying professional experience.

The CPA Journal is broadly recognized as an outstanding, technical-refereed publication aimed at public practitioners, management, educators, and other accounting professionals. It is edited by CPAs for CPAs. Our goal is to provide CPAs and other accounting professionals with the information and news to enable them to be successful accountants, managers, and executives in today's practice environments.

Visit the new cpajournal.com.