Accounting For Stock Options

By Abraham J. Briloff

The FASB would be well advised to forget its Black-Scholes fair value method of accounting for stock options and proceed instead with Occam’s Razor. By definition, Occam’s Razor advises that “the simplest of competing theories should be preferred to the more complex.” And there is a simple, traditional method of accounting for the economic ramifications of stock options.

But first, what is FASB’s present position? In 1995, SFAS 123, Accounting for Stock-Based Compensation, declared that the starting point for the accounting process was to be the so-called fair value determined at the time of the grant of options, and that fair value was generally presumed to be determined by the Black-Scholes option pricing model. Fair value, once determined, was then to be amortized over the employees’ service periods. This convoluted mathematical configuration has met with universal condemnation, and FASB has since tried to extricate itself from the standard’s implications.

Case Study

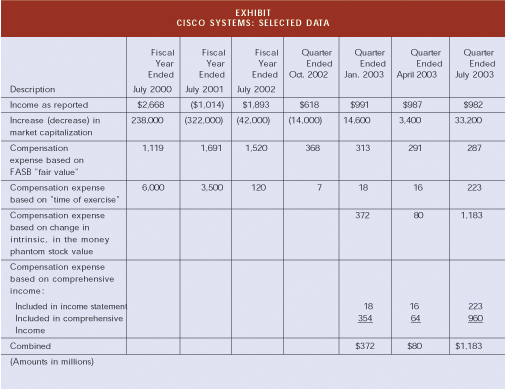

A dramatic manifestation of the irrational consequences flowing from FASB’s rules can be seen in the experience of Cisco Systems. For its fiscal year ended July 2000, Cisco’s reported income was $2,668 million and its market capitalization increased by a whopping $238 billion. For that year, SFAS 123 would direct an additional compensation expense of $1,119 million.

In fiscal 2001, when Cisco’s bottom line saw a loss of $1,014 million and market capitalization that fell by $322 billion, SFAS 123 would nonetheless direct that Cisco book incentive compensation of $1,691 million.

For 2002, Cisco’s income was reported as $1,893 million; during that year, its market capitalization declined by another $42 billion. Still, FASB would decree an incentive bonus charge of $1,520 million.

For Cisco’s first quarter in fiscal 2003 (ended October 2002), when its reported income was $618 million and its market capitalization declined by another $14 billion, the fair value charge would be $368 million. For its January 2003 quarter, when its income was $991 million and its market capitalization increased by $14,600 million, the SFAS 123 charge would be $313 million. For the April 2003 quarter, when its income was $987 million and its market capitalization increased by another $3,400 million, the SFAS 123 charge would be $291 million. For its final quarter ended last July, when Cisco’s reported income amounted to $982 million and its market capitalization increased by more than $33,200 million, the SFAS 123 compensation expense would be $287 million.

In sum, while an incentive compensation program should result in a variable cost that would track the performance of the enterprise (i.e., income and shareholder value), FASB’s fair value directive induces something more closely resembling a fixed cost.

If one were to reject FASB use of fair value at the time of grant as the critical event for the accounting process, one could move to the other end of the time spectrum.

Assume, for example, that in 1995 corporation X granted options for 10,000 shares to a cadre of employees, with a strike price of $10 a share (the market price at the time), all of which were exercised in 2003 when the share price was $50. Under the time of exercise, corporation X would recognize the employee compensation expense of $400,000, i.e., the per share appreciation of $40 multiplied by the 10,000 options. Note that neither the $10 nor the $50 is arbitrary, nor is it determined by some incomprehensible mathematical method. It is simple arithmetic.

Simple as it might sound, the process can be fully justified through traditional accounting, tax, and economic concepts. For tax purposes, the grant of the option is ignored for both corporation X and the employees. Instead, it is at the time of exercise that corporation X receives a tax deduction for the $400,000 and the employees are subject to tax on that $400,000 of appreciation realized by them upon exercise.

The designation of time of exercise as the critical event for the recognition of the cost of stock options is rooted in SFAS 5, Accounting for Contingencies. That statement would also direct that the compensation expense related to the stock option plans be recognized at the time of exercise. Until then, the obligation is only contingent.

Again, consider Cisco’s experience with the time of exercise

in mind. The data are constrained to the inferences that can be drawn from the

tax benefit derived by the company as a consequence of the exercise by the employees.

Thus, the statement of shareholders’ equity informs us of the amount of

the tax benefit; assuming that factor to represent one-third of the pretax compensation,

the after-tax expense for Cisco would be two-thirds of that

pretax expense.

Accordingly, the following figures can be derived from Cisco’s 2002 10-K:

During its 2003 fiscal year, Cisco’s options holders cashed in options which on an after-tax basis would add about $264 million to Cisco’s compensation expense ($7, $18, $16, and $223 millions for the quarters, respectively).

However justifiable this time of exercise accounting for stock option expense might be under tax and accounting concepts, it lacks symmetry when compared with the objectives of stock option plans: to provide incentives for increases in employer income and related shareholder value.

So in my view, SFAS 123 rules are essentially devoid of economic or accounting logic. The time of exercise alternative may be entirely consistent with underlying precepts for the recognition of a cost that had been festering as a contingency.

The ‘Phantom’ Alternative

There is a third alternative, one more squarely in accord with accounting and economic paradigms, and is unfortunately being ignored: “phantom” or “shadow” stock programs. These executive compensation programs were in vogue before stock options became the catalyst for providing incentives for executives, and are simple indeed. As opposed to using Black-Scholes, these arrangements require nothing but basic arithmetic, carried out with pencil and paper.

For example, assume a phantom stock arrangement whereby at the end of five years an executive would be paid an amount equal to the appreciation on 10,000 shares. The economics implicit in the deal are little different, if at all, from what is presumed to be involved in a typical stock option arrangement. But the accounting treatment is dramatically different.

If in the first year following the phantom stock arrangement the market price of a share appreciates $10, the employer would accrue $100,000 of compensation expense. That is fair and logical if it is assumed that the arrangement is intended to provide an incentive, that is, to add to shareholder value as measured by the change in the market price for the employer’s stock.

If in the second year there is an actual decline of $2 per share—so that the appreciation from the base price is just $8—then $20,000 of the first year’s $100,000 accrual is reduced, with a corresponding $20,000 reduction in compensation expense. This, too, is fair because there was a negative factor in the shareholder value presumed to have been the consequence of an impairment in the effectiveness of the executive’s contribution.

If by the end of the fifth year the stock appreciates $40 per share, the executive would be entitled to receive $400,000 under the arrangement. That $400,000 would be the same amount accounted for under the time-of-exercise method; however, under this phantom stock arrangement, the accounting recognition would precisely track the changes in stock price, thereby reflecting the effectiveness of the presumed incentive over each period. In today’s argot, the $10 might be referred to as the “strike price” and the period-to-period overplus might be dubbed as the “intrinsic value” or “in the money.”

Interestingly, Cisco’s 10-Q for the first quarter of its 2003 year began providing data reflecting the accumulated intrinsic value or in the money for the options which were exercisable as of that date. As of October 2002, in-the-money exercisable options had an aggregate intrinsic value amounting to $1,279 million; this, then, is the figure that represented the accumulated liability as of that date, essentially a sum equal to the liability which would prevail under the phantom or shadow relationships.

Because of the rise in Cisco’s market price from $11.78 to $13.86 during Cisco’s second quarter (ended January 2003), the accumulated intrinsic value increased $537 million to $1,816 million. To this $537 million should be added the $25 million of compensation expense implicit in the options exercised during the period, so that the aggregate compensation expense implicit in the options plans attributable to Cisco’s January 2003 quarter would be $562 million pretax, or $372 million net of tax. The after-tax amount would represent 37.5% of Cisco’s $991 million reported income for the quarter ended January 2003; it would represent 2.5% of the increase in market capitalization.

In the third quarter, during which Cisco’s stock price rose from $13.86 to $14.34, the aggregate intrinsic value of the exercisable options rose only $98 million, to $1,914 million by the end of April 2003. To that $98 million increase, $25 million must be added, representing the pretax compensation cost embedded in the options exercised, for an aggregate pre-tax compensation expense of $123 million, or $80 million net of tax. The after-tax amount would represent 8.1% of Cisco’s $987 million reported income for the quarter ended April 2003; or, 2.4% of the increase in market capitalization.

During the fourth quarter, when its stock price rose from $14.34 to $19.08, the aggregate value of Cisco in the money exercisable options increased by $1,440 million, to $3,354 million. The addition of $333 million representing the pretax compensation cost embedded in the options exercised yields an aggregate pre-tax compensation expense of $1,773 million, or $1,183 million after tax. The after-tax amount would represent more than 100% of the company’s $982 million reported income for its final 2003 quarter; or, 3.6% of the increase in market capitalization.

This compensation expense factor is entirely logical; it reflects the compensation earned during the respective quarters by Cisco’s employees as their incentive for generating shareholder value. That the employees did meet that objective is evidenced by the fact that Cisco’s market capitalization for its seven billion shares increased by about $14.6 billion, $3.4 billion, and $33.2 billion during these quarters, respectively.

How should the objective of relating the expense to changes in the accrued liability be accomplished by FASB? Eliminate all of the provisions in SFAS 123 except for Paragraph 25, which reads:

Some awards of stock-based compensation result in the entity’s incurring a liability because employees can compel the entity to settle the award by transferring its cash or other assets to employees rather than by issuing equity instruments. For example, an entity may incur a liability to pay an employee either on demand or at a specified date an amount to be determined by the increase in the entity’s stock price from a specified level. The amount of the liability for such an award shall be measured each period based on the current stock price. The effects of changes in the stock price during the service period [generally the vesting period] are recognized as compensation cost over the service period … Changes in the amount of the liability due to stock price changes after the service period are compensation cost of the period in which the changes occur. [Italics added.]

FASB should then eliminate the phrase “rather than by issuing equity instruments,” because it prevents a reckoning consistent with traditional accounting and economic precepts and was provided arbitrarily and gratuitously.

Furthermore, inasmuch as the employer is presumed to be able to issue shares for cash at the prevailing market price, and use the avails to settle the compensation arrangement, the opportunity cost implicit in the issue of the equity instruments can be considered equivalent to the payment of cash or other assets.

FASB should be constrained to concur in this judgment. Paragraphs 20–23 of SFAS 141, Business Combinations, direct that cash and other assets as well as the issuance of equity instruments are to be homogenized in determining the cost to be booked on a merger or acquisition. Here, equity instruments are indistinguishable from cash or other assets in determining their accounting implications, at least insofar as measuring the amount to be booked as a cost.

An

Optimal Alternative

An

Optimal Alternative

Adapting a method used for an enterprises investment securities, the author derived a method that provides the benefits of both the time of exercise and phantom stock alternatives above. According to SFAS 115, the accounting for an enterprise’s investments in equity securities (i.e., stocks) follows two tracks:

As a consequence, the entire change in the enterprise’s investment experience is reflected by the combined amounts. To the extent that options were exercised during a period, the related compensation expense would be entered directly onto the income statement. The changes in the in-the-money aggregate during the period—attributable to the unexercised exercisable options—would be entered into comprehensive income.

How would this alternative cope with Cisco’s experience? Factoring in the selected Cisco January 2003 quarterly data on this two-track matrix would involve:

The aggregate effect on Cisco’s comprehensive income would be a $372 million reduction—the same amount that would be subtracted for Cisco’s bottom line under the phantom, shadow, mark-to-market alternative.

The quarter ending in April 2003 would involve:

The aggregate effect on Cisco’s comprehensive income would be an $80 million reduction—the same amount that would be subtracted from Cisco’s bottom line under the phantom, shadow, mark-to-market alternative.

The quarter ending in July 2003 would involve:

The aggregate effect on Cisco’s comprehensive income would be a $1,183 million reduction—the same amount that would be subtracted from Cisco’s bottom line under the phantom, shadow, mark-to-market alternative.

This two-track alternative is especially preferable because, first, the income statement clearly and compellingly informs the reader regarding the extent to which those closest to the employer have determined to exercise their options. Second, the extent to which the interests of the option holders continue to be aligned with the shareholders can be easily discerned through the comprehensive income.

This alternative method of accounting for stock options has the potential to provide investors with the information they desire without the complexities inherent in using Black-Scholes or fair value. For the next two years, as an interim solution, both elements of the compensation expense derived from stock options should be reflected on the comprehensive income section. Based upon such a transitional implementation, the investing public and the financial community should be in a position to determine whether this pattern of stock option compensation expense disclosure is significant or even relevant.

The CPA Journal is broadly recognized as an outstanding, technical-refereed publication aimed at public practitioners, management, educators, and other accounting professionals. It is edited by CPAs for CPAs. Our goal is to provide CPAs and other accounting professionals with the information and news to enable them to be successful accountants, managers, and executives in today's practice environments.

Visit the new cpajournal.com.