November 2003

Sports Franchise Acquisitions: Valuation of Intangible Assets. Part 2 of 2

By Robert F. Reilly

This article concludes a two-part series on purchase price allocations of professional sports franchise acquisitions. Part One discussed financial and tax-related purchase price allocation procedures. Part Two will focus on the identification, valuation, and remaining useful life (RUL) analysis of franchise intangible assets. It will conclude with a detailed example of an allocation.

Valuation Procedures

Sports

franchise intangibles are valued using sales comparison, cost, and income

valuation approaches. A valuation approach represents a category of related

economic analysis methods, or related valuation methods. Within each method

are a number of specific procedures, which may be either qualitative or quantitative.

These procedures build up to valuation methods, which then aggregate to valuation

procedures.

Sports

franchise intangibles are valued using sales comparison, cost, and income

valuation approaches. A valuation approach represents a category of related

economic analysis methods, or related valuation methods. Within each method

are a number of specific procedures, which may be either qualitative or quantitative.

These procedures build up to valuation methods, which then aggregate to valuation

procedures.

Many sports franchise intangibles assets, their valuation data sources, and thus the application of valuation procedures, are specific to the industry. In addition, most of the qualitative procedures require analytical judgments and experienced reasoning that are industry-specific. Franchise owners and their advisors should understand that all valuation approaches can be used to estimate market value. All valuation variables should be empirically based and market-derived. It is the marketplace of actual franchise buyers and sellers who actually determine sports industry intangible asset market values.

Sales comparison approach. The sales comparison, or market, approach is based on transactional data regarding arm’s-length, third-party sales or licenses of discrete intangible assets. These data are extracted from the marketplace and analyzed to conclude cash equivalency prices for the intangible sales or licenses. Both the transactional intangibles and the subject intangible are analyzed on common quantitative fundamentals, while intangible pricing metrics are calculated based on common units of comparison. Depending on the quantitative fundamentals’ comparative analysis, subject-specific pricing metrics are selected from the range of transactional pricing metrics. The selected pricing metrics are applied to the subject’s fundamentals to derive an estimated value.

The market approach considers both intangible asset sales and licenses or leases. Accordingly, the market approach examines market-derived license fees, royalty rates, profit split percentages, and other intangible asset transfer price arrangements, in addition to fee simple intangibles sales. All valuation methods within the market approach rely on commercial transfers of naked (i.e., individual or unbundled) intangibles. For this reason, the guideline sales method, guideline license method, market rental income method, and other market approach methods often are not applicable to sports franchise intangibles, as individual intangibles are seldom sold or licensed between franchise owners. Nonetheless, when the market approach can be used to value stadium leases, concession agreements, trademark licenses, and other such intangibles, it does provide a convincing valuation analysis.

Cost approach. The cost approach is based on the economic principles of substitution and utility. The conceptual premise is that a franchise buyer will pay no more for an intangible asset than the cost of a substitute intangible that provides the same utility. Most cost approach methods estimate cost in current dollars as of the valuation (acquisition) date. The two common measures of cost are replacement cost, which seeks to replace the utility of an asset, and reproduction cost, which seeks to replicate it. For an intangible, replacement cost is typically not the same as, and is often much lower than, reproduction cost.

Whether measured by either model, an intangible’s cost is not the same as its value. Cost has to be adjusted for obsolescence in order to estimate value. The four common forms of obsolescence are physical deterioration, functional obsolescence, technological obsolescence, and external obsolescence. Physical deterioration may affect sports intangibles such as player contracts.

The total cost measure, less obsolescence, results in a value indication. Obsolescence is a function of the subject’s condition, its expected remaining useful life (RUL), and the cost measure selected—either replacement or reproduction.

Income approach. The income approach is based on the present value of a future economic income stream. There are two principal methods in the income approach: direct capitalization or yield capitalization. Direct capitalization is used when the intangible is expected to generate a normalized income, changing at a constant rate over time; the rate can be positive, negative, or zero. Yield capitalization is used when the intangible is expected to generate uneven (and unrelated) income over discrete periods of time. Because many sports franchises do not earn positive accounting income, cash flow–based measures of economic income are commonly used.

An intangible’s value is the present value of the income it is expected to generate for its owner, operator, or lessor. This is calculated by multiplying a projection of periodic income amounts by a corresponding series of present value discount rates, or by dividing a normalized single period income projection by a direct capitalization rate. While various measures of economic income can be used, the selected discount and capitalization rates should be consistent with the projected income. The selected discount or capitalization rate is a function of two factors: the market’s expected rate of return on investment, and the expected duration of income generation. Because it is difficult to extract the expected return on investment, analysts typically use market-derived costs of capital. Due to limited data, analysts often use a franchise owner’s cost of capital as a proxy for the market.

The income projection term depends upon the intangible’s expected RUL. For most franchise intangibles, RUL is a function of either the legal or contract life, or the actuarial or analytical life. Although many sports franchise intangibles have finite contractual lives, some contract-related intangibles’ expected RUL is greater than their current term to maturity, due to expected contract renewals (e.g., season ticket holders). An actuarial analysis is performed on the historical placements, retirements, and turnover rates on these intangibles in order to estimate the expected number of renewals. Accordingly, the appropriate discount or capitalization factor for each intangible is a function of the expected rate of return (i.e., investor’s cost of capital) divided by the intangible’s RUL.

The rate is also influenced by the premise of value appropriate to the valuation assignment. Although the premise of value can be considered as separate from other assets or as part of the whole, for purchase price allocations, it should be valued as part of a going-concern sports franchise. Analysts typically derive discount or capitalization rates related to the sports franchise when valuing intangibles for purchase price allocation purposes.

The intangible’s RUL analysis is an important procedure in the valuation process, and is an integral component of each approach. The RUL affects the selection of the income projection period, the selection of comparative sale/license transactions, and the quantification of obsolescence, in the income, sales comparison, and cost approaches, respectively.

Value synthesis and conclusion. The value synthesis and conclusion is the final procedure in the valuation process. If two or more approaches or methods were used, the analyst has to reach a final value estimate. First, each analysis is reviewed in order to—

Second, the analyst assigns a weighting to each value indication based on—

Valuation Methods

The facts and circumstances of the actual assignment should ultimately decide the appropriate valuation methodology.

Personnel-related intangibles. For human capital–related intangibles, the cost approach is often used. For administrative personnel, value is often a function of the cost to recruit, hire, and train an assembled workforce possessing equivalent skills and experience. For the coaching and player development staff, the replacement cost method may also be used. The recruitment costs for these employees can be quite large. If a coach is signed to a below-market compensation agreement, the income approach’s cost savings method may be applicable. The projected cost savings usually are not long term. Most likely, the coach will negotiate a market level of compensation at the next contract renewal.

Player contracts are often valued using a cost approach method. The multiyear player development process is specific to the sport, the athlete’s position, his experience, and his unique ability. However, the analytical procedure of estimating the current cost to replace a player is still applicable when valuing these contracts.

A contract athlete’s replacement cost analysis involves a detailed examination of the procedures the franchise would use to hypothetically replace its current roster. The analyst considers the costs and player development activities of farm teams, minor leagues, and other training programs. The valuation also involves a detailed analysis of each player, in terms of position, statistics, age, experience, and medical condition. Furthermore, the analysis looks closely at each contract, including compensation, term to maturity, expected renewals (based on a rigorous RUL analysis), and any contract-specific conditions. Coaches, franchise officials, sportswriters, industry experts, and other authorities are often consulted.

Replacement cost analysis may conclude a unique value estimate and a unique RUL estimate for each acquired contract. As with senior coaches, the franchise may have a superior athlete under contract at below-market compensation. In this case, the cost savings method may be used. It is unlikely that an athlete would accept below-market compensation beyond the term of the current contract.

Other contract-related intangibles. These analyses often use the income approach, and typically involve estimating the present value of the economic income projected to be earned by the franchise over the contract RUL (including expected renewals). The specific type of economic income depends on the contract, but it may include broadcast rights income, advertising sales income, product royalty income, commission income, profit split income, rental income, license income, and endorsement income. Favorable vendor contracts may be valued using a cost savings method, where the reduction in operating costs (compared to non-contract market raters) is both projected and present-valued over the current contract’s RUL.

For real estate–related (lease) contracts, some form of yield capitalization or direct capitalization method also applies. The first type is the rental income from skyboxes, stadium advertising, and special events held in the stadium. The second type is any below-market rent cost savings associated with a favorable lease on the stadium, training facility, and administrative office. These two types of property-related economic income are not mutually exclusive. The present value of the projected economic income over the lease term provides the value indication.

Season ticketholders are often valued using the income approach. This analysis considers: the RUL of each ticketholder relationship, current and future ticket prices, and the cost of providing services to the ticketholder. The present value of the expected future net income from season subscriptions provides the value indication.

The national franchise agreement can be valued several ways. The franchise value is sometimes based on the present value of projected ticket sales net income and any other income not assigned to other intangibles. This projection is made over the term of the expected RUL. Another method used is to project the total economic income expected to be generated from all sources over the franchise RUL. From this “gross” economic income projection, a fair rate of return on each of the other identified intangibles is subtracted. The present value of this net economic income projection (i.e., total annual income less the annual rate of return on all other intangibles) over the franchise RUL provides the value indication.

Goodwill is typically valued based on a residual analysis. The residual value assigned to the acquired goodwill is the—

Purchase Price Allocation Example

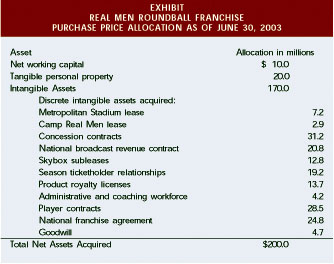

Roundball is an established professional sport, and the National Roundball League (NRL) grants roundball franchises. The Real Men organization of Metropolitan City is a successful NRL franchise. On June 30, 2003, the Big Buckos Organization purchased the Real Men for a total consideration of $200 million. The following simplified example illustrates this sports franchise purchase price allocation.

Tangible assets. On the transaction date, the Real Men franchise had $10 million of net working capital (NWC), including receivables, inventory and supplies, prepaid expenses less accounts payable, and accrued expenses. The franchise also had tangible personal property (TPP) worth $20 million, appraised at market value. This included office and computer equipment, transportation equipment, and athletic equipment. The Real Men franchise owned no real estate.

Intangible assets valuation. Based on these facts, the Real Men franchise purchase includes a $170 million allocation to intangible assets ($200 million total purchase price less $10 million NWC and $20 million TPP).

The valuation analyst concluded that the franchise owned a number of intangible assets as of June 30, 2003, including the following:

Metropolitan Stadium lease. The stadium is leased from the Metropolitan City Stadium Authority at an annual rent $1 million below the current market rate. This rental advantage is based on a rate comparison for major sports arenas in other cities, after making adjustments for size, construction, age, and location of the subject venue, compared to selected arenas. The remaining lease term is 20 years. The appropriate present value discount rate (pretax income) is 15%, yielding a stadium lease value of $7.2 million.

Camp Real Men lease. A similar analysis was performed on the Camp Real Men training facility lease. The franchise is expected to save $500,000 per year (compared to current market rents) over the remaining 10-year lease term. The annual rental advantage’s present value, at the corresponding 15% present discount rate, is $2.9 million.

Concession contracts. The Metropolitan Stadium concession contracts generate $4 million a year in net economic income for the franchise, which is calculated after subtracting all related facility and operating expenses, investments, and capital charges related to associated tangible and intangible assets. The income is expected to increase at 6% per year over the contracts’ average remaining 12-year term. The present value of the total concession-related contract income is $31.2 million.

National broadcast contract. The contract with the NRL produces $5 million of economic income per year to the Real Men, and is expected to increase at 5% per year over the five-year contract RUL. The present value of the broadcast income is $20.8 million.

Skybox subleases. Skybox-related net economic income of $2 million per year is expected to increase at 8% annually over the expected sublease renewals’ eight-year average RUL. This economic income stream is measured after appropriate allowances for facility and operating expenses, investments, and capital charges related to associated tangible and intangible assets. The present value of the sublease income is $12.8 million.

Season ticketholder relationships. These assets’ average expected RUL is six years, with projected subscription revenues of $10 million, increasing at 5% per year. After appropriately allocating all operating expenses and associated capital charges, the season ticketholder relationships produce $4 million per year in net economic income. The present value of the ticketholder income is $19.2 million.

Royalty licenses. The Real Men franchise receives $6 million per year in product license fees and royalty income, which is expected to increase at 5% per year. The licenses generate $5 million per year in net economic income, and have an average expected RUL of three years. The present value of the licensing income is $13.7 million.

Administrative and coaching workforce. An analyst estimated the current cost to recruit, hire, and train a replacement workforce of coaching and player development staffs with equivalent credentials and expertise. Appropriate obsolescence allowances were subtracted from the replacement cost (e.g., for employees nearing retirement). The depreciated replacement cost for the nonplayer employees is $4.2 million.

Player contracts. On average, it costs about $2 million to develop one professional roundball player (who plays for one complete season for an NRL team) through the farm system. After considering each player’s position, performance, experience, age, and compensation, the analyst concluded that the combined value of the 25 player contracts is $28.5 million.

National franchise agreement. An analyst estimated the total intangible value (TIV) of the Real Men franchise over the national franchise agreement expected RUL. The TIV was estimated using a yield capitalization (discounted cash flow) valuation model, by first considering the franchise’s economic income projections, then subtracting appropriate economic rent or capital charges for all assets used up in making the projection. The TIV result is $165.3 million. All of the discrete intangible asset’s individual values are then subtracted. Since the TIV is calculated over the franchise agreement RUL, the residual value may be assigned to the franchise agreement. As shown in the Exhibit, the franchise agreement’s value comes to $24.8 million.

Goodwill. The total purchase price for the Real Men franchise was $200 million, of which $10 million was allocated to net working capital (NWC) and $20 million to tangible personal property (TPP). The total value of the 10 discrete intangible assets listed above is $165.3 million, yielding a residual purchase price to be allocated to acquired goodwill of $4.7 million.

Editor:

Martin J. Lieberman, ASA, CPA/ABV

The CPA Journal is broadly recognized as an outstanding, technical-refereed publication aimed at public practitioners, management, educators, and other accounting professionals. It is edited by CPAs for CPAs. Our goal is to provide CPAs and other accounting professionals with the information and news to enable them to be successful accountants, managers, and executives in today's practice environments.

Visit the new cpajournal.com.