August 2003

New York State 2003/04 Budget

By Mark H. Levin, CPA, H.J. Behrman & Company, LLP

The last time the New York State legislature overrode a governor’s veto on the state budget was in 1982, when Hugh L. Carey was governor. In 2003 it happened twice. On May 15, the legislature overrode the governor’s veto of the 2003/04 Budget Bill. Then, on May 19, the legislature overrode the governor’s veto of the New York City Aid Bill. These pieces of legislation make major changes to the New York State Tax Law and to the City of New York Administrative Code.

Personal Income Taxes

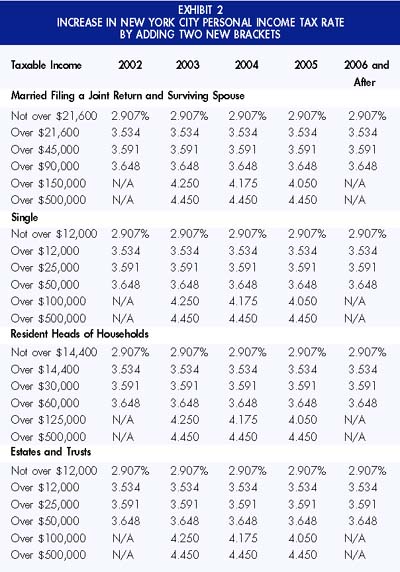

Effective for tax years 2003, 2004, and 2005, there will be two additional tax brackets for New York State taxable incomes in excess of $150,000 (for married taxpayers filing jointly). These new brackets will expire in 2006. The new tax tables are shown in Exhibit 1. Over the same period of time, there will be similar new brackets for New York City income taxes as well.

For New York City taxpayers in the two new brackets, the increase is not merely on marginal income; at taxable incomes above $250,000, the rate will be 4.450% of all taxable income.

Estimated tax payments. Beginning with the June 15, 2003, quarterly estimated tax for individuals and estates and trusts with taxable income in excess of $150,000 ($75,000 for married filing separately), the safe-harbor payment must be computed by starting with 2002 taxable income and using the new tax rate schedule for 2003 (Exhibit 1). The projected 2003 tax is then subject to the same 100%–150% rules as under the prior law.

Compensating use tax. Effective immediately, the personal income tax forms will have lines to report unpaid compensation use tax.

Business and Corporate Taxes

Withholding for nonresidents. Effective for all years ending after December 31, 2002, all entities taxed as partnerships and S corporations must remit estimated taxes for nonresident individuals and C corporation partners/members/shareholders at the highest tax rate. The withholding for individuals is at 7.7% for 2003, 2004, and 2005, and 6.85% after 2005, and the withholding for C corporations is at 7.5%. All amounts withheld will be treated as estimated tax paid by the partner or S corporation shareholder.

The withholding is to be paid quarterly on the dates prescribed for making the personal income tax estimated payments: April 15, June 15, September 15, and January 15. All payments that would have been due on April 15, 2003, and June 15, 2003, will be considered timely if made by September 15, 2003.

Any partnership or S corporation that is required to make estimated tax payments for the benefit of its nonresident partner/member/shareholder must furnish such nonresident partner/member/shareholder with a statement showing the amount of the tax withheld. This statement is due within 30 days after the quarterly payment of the withholding by the partnership or S corporation.

Withholding is not required for any partner/member/shareholder whose withholding

is $300 or less. Withholding is also not required for any partner/

member/shareholder included in a group return.

A penalty of $50 per required partner will be assessed if the nonpayment was willful neglect. The penalty will not apply where the nonpayment was due to reasonable cause. Interest will be due on any underpayment of withholding tax due.

Refunds of overpaid withholding tax shall be made to a partnership or S corporation only to the extent that such overpayment is attributable to a partner or shareholder for whom the entity was not required to pay the withholding tax.

Real estate. Effective September 1, 2003, New York State withholding will be required (with certain exceptions) on the sale of New York real estate by nonresidents. The withholding will be based on the gain on the sale and will be at the highest personal income tax rate (7.7% for 2003–2005, and 6.85% thereafter).

The following sales will be exempt from this withholding:

Increased LLC/LLP filing fees. Effective for tax years 2003 and 2004, the LLC fee is increased to $100 (formerly $50) per member or partner at year-end. In addition, the minimum filing fee is increased to $500 (formerly $325), while the maximum filing fee is increased to $25,000 (formerly $10,000). Single-member LLCs are now subject to a $100 filing fee (previously, single-member LLCs were not subject to the filing fee).

These increases will expire for tax years beginning on or after January 1, 2005. The above LLC/LLP fees are now due and payable on the January 30 following the end of the taxable year. This new due date is permanent.

Passive intangible income (“Geoffrey” transactions). Effective for taxable years beginning on or after January 1, 2003, New York State will close the loophole allowing companies to pay royalties to a foreign related corporation (usually a Delaware corporation, because Delaware does not tax intangible income). The paying company would receive a deduction for the royalty expense paid, while the receiving corporation would receive the royalty income free of New York State (or any other state’s) taxes.

Effective January 1, 2003, both New York State and New York City will disallow any deduction to a related entity that is not for a valid business purpose and subject to tax by the related entity in New York, or another state, or a foreign country.

Decoupling from federal bonus depreciation. Effective for property placed in service on or after June 1, 2003, New York State will decouple from the federal 30%/50% “bonus” first-year depreciation permitted under IRC section 168(k) (except for property located in the Liberty or Resurgence Zones). The disallowed depreciation will be replaced by a depreciation deduction computed under the general MACRS rules of IRC section 168. This decoupling is similar to the prior New York City decoupling.

SUV deduction. Effective for years beginning on or after January 1, 2003, New York will no longer allow the section 179 deduction for sport utility vehicles weighing more than 6,000 pounds (except for farmers).

Sales Taxes

Effective June 1, 2003, through May 31, 2005, the New York State sales tax rate will increase from 4% to 4.25%. New York City was authorized to increase the New York City sales tax on June 4, 2003, from 4% to 4.125%.

Streamlined sales tax project. New York State is now permitted to join other states in developing a simplified sales tax system. Based on Supreme Court rulings, companies that do not have physical presence (nexus) in a particular state are not required to collect sales tax for that particular state; this applies mostly to Internet and mail-order catalog sales. The Court’s opinion is that remittance of sales tax to various jurisdictions would cause an undue burden on retailers because tax levels and exemptions vary so widely between states. Instead, the consumer has the legal responsibility to pay the use tax directly to the state, although this provision is difficult to enforce.

The Streamlined Sales Tax Project (SSTP) is an effort to convince Congress that the states can simplify the current sales tax system without causing an undue burden on retailers. New York now joins 37 other states, including California and the District of Columbia, that have enacted the Simplified Sales and Use Tax Administration Act, which authorizes those states to enter into multistate negotiations to streamline their sales and use tax laws.

Clothing. Effective June 1, 2003, the sales tax

exemption on clothing costing less than $110 is repealed. This exemption will

be reinstated effective June 1, 2004.

During the period of revocation there will be two sales tax holidays for clothing

costing less than $110, one starting on the Tuesday preceding the first Monday

of September (Labor Day) and ending on Labor Day, and the other starting on

the Tuesday preceding the third Monday of January (Martin Luther King Day)

and ending on Martin Luther King Day.

Cigarettes. Effective September 1, 2003, the state sales tax on cigarettes will be computed after the New York City cigarette excise tax has been added to the price.

Native American sales. Effective August 14, 2003, all retail sales made on Native American Nation or Tribal lands to non–Native Americans will be subject to sales tax. The legislation specifically mentioned several items, including cigarettes and motor fuel, as well as covering retail sales in general.

In the 1994 Attea v. Wetzler case, the New York State Supreme Court ruled that New York had the authority to collect taxes on cigarettes and fuel sold at Indian reservations. The ruling stated that “enrolled tribal members purchasing cigarettes on Indian reservations are exempt from a cigarette tax but [non–Native Americans] making purchases are not.”

New York City Amnesty

The

Commissioner of the New York City Department of Finance shall establish a

three-month amnesty program, to be effective during the fiscal year beginning

July 1, 2003. As of this writing, no date for the amnesty has been set. The

amnesty shall apply to tax liabilities for taxable periods ending, or transactions

occurring, on or before December 31, 2001. Taxes that will be eligible for

amnesty include the unincorporated business tax, general corporation tax,

financial corporation tax, and transportation corporation tax.

The

Commissioner of the New York City Department of Finance shall establish a

three-month amnesty program, to be effective during the fiscal year beginning

July 1, 2003. As of this writing, no date for the amnesty has been set. The

amnesty shall apply to tax liabilities for taxable periods ending, or transactions

occurring, on or before December 31, 2001. Taxes that will be eligible for

amnesty include the unincorporated business tax, general corporation tax,

financial corporation tax, and transportation corporation tax.

Amnesty will be available to any taxpayer who is a party to a currently pending administrative proceeding or civil litigation commenced in the City of New York Department of Finance Conciliation Bureau, the Tax Appeals tribunal, or any court of the state that is pending on the date of the taxpayer’s amnesty application. The taxpayer must withdraw from such proceeding or litigation prior to the granting of amnesty, and the litigation cannot involve a matter that was the subject of an audit pending on March 10, 2003.

Amnesty will not be granted to a taxpayer for any tax for which the taxpayer received any benefit under the amnesty during the fiscal year beginning July 1, 1994, or the amnesty during the fiscal year beginning July 1, 1985.

Amnesty will not be granted to a taxpayer—

Taxpayers accepted under the amnesty program will have all penalties waived. No refund is available for any penalty paid prior to the taxpayer’s amnesty application. Taxpayers accepted under the amnesty program will effectively owe interest equal only to the immediate three years prior to the deficiency. Any interest accrued prior to three years will be waived. No refund is available for any interest already paid.

Other Tax Issues

Real property transfer tax. Effective May 19, 2003, where there is a transfer of an economic interest in any entity that owns real property, the consideration subject to the real property transfer tax shall be deemed equal to the fair market value of the interest transferred multiplied by the percentage of the ownership interest in the entity transferred.

Class one property owned by absentee landlords. Effective for real estate tax years beginning on July 1, 2003, and July 1, 2004, New York City is authorized to impose a surcharge on the real property tax on class one property of 25% in 2003 and 50% in 2004. This surcharge will apply to all class one property (excluding vacant land) that provides rental income and is not the primary residence of the owner or owners, or the primary residence of the parent or child of the owner.

Underpayment interest rate. Effective May 1, 2003, the interest rate on underpayments for both New York State and New York City may not be less than 6%, and the New York City interest rate on underpayments is increased to the federal short-term rate plus 5% (formerly plus 3%).

Editor:

Mark H. Levin, CPA

H.J. Behrman & Company LLP

Contributing Editors:

Henry Goldwasser, CPA

Weiser LLP

Neil H. Tipograph

Imowitz Koenig & Co., LLP

Warren Weinstock, CPA

Marks Paneth & Shron, LLP

The CPA Journal is broadly recognized as an outstanding, technical-refereed publication aimed at public practitioners, management, educators, and other accounting professionals. It is edited by CPAs for CPAs. Our goal is to provide CPAs and other accounting professionals with the information and news to enable them to be successful accountants, managers, and executives in today's practice environments.

Visit the new cpajournal.com.