May 2003

Building an XBRL IFRS Taxonomy

By Kurt P. Ramin and David A. Prather

Inventory,

stocks, Vorräte, Rimanenze, éléments de stocks, investmentföretag.

Six concepts, or one concept expressed in six languages? Your average multilingual

accountant, analyst, or investor would conclude that “inventory”

has been translated into U.K. English, German, Italian, French, and Swedish,

respectively. However, to a computer, the former is correct because: inventory

= Vorräte is false, as is stocks = any of the other translations.

Inventory,

stocks, Vorräte, Rimanenze, éléments de stocks, investmentföretag.

Six concepts, or one concept expressed in six languages? Your average multilingual

accountant, analyst, or investor would conclude that “inventory”

has been translated into U.K. English, German, Italian, French, and Swedish,

respectively. However, to a computer, the former is correct because: inventory

= Vorräte is false, as is stocks = any of the other translations.

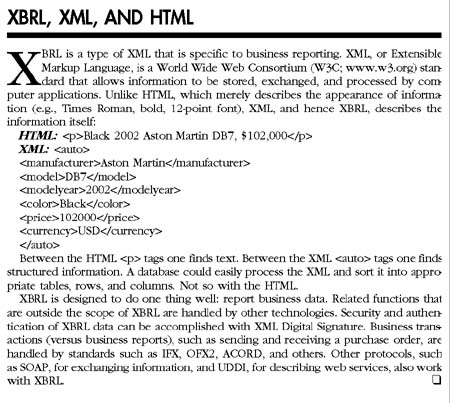

It may seem a bit odd that computer programs are unable to discern that “inventory” and its various other linguistic representations are actually the same concept. The fundamental problem is that it is very difficult for computer programmers to make these seemingly straightforward associations. Even if the aforementioned terms were programmed to be conceptually equal, there would remain an indeterminable number of variations (e.g., “Inventory,” “inventory,” “Inventories” are all different in the computer’s mind). Can business concepts be made less ambiguous to computers? Yes. Today the processes of storing, exchanging, analyzing, and reusing business information are advancing rapidly because of a new digital business language: XBRL (Extensible Business Reporting Language).

International Accounting Standards in a Digital Format

As Samuel A. DiPiazza, Jr., and Robert G. Eccles of PricewaterhouseCoopers note, “…the market expects [companies] to provide ever more timely and higher quality information.” Part of their solution is XBRL (Building Public Trust, reviewed in the February 2003 CPA Journal). Leading XBRL development worldwide is XBRL International (www.xbrl.org), a global consortium of accounting organizations, accounting firms, banks, governmental agencies, software developers, business information providers, and business reporting stakeholders. The International Accounting Standards Committee Foundation (IASCF) is working with other consortium members to translate International Financial Reporting Standards (IFRS, IAS, and SIC) into XBRL.

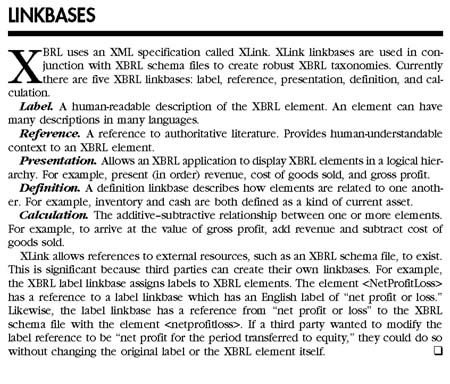

Digital translations, known as XBRL elements tags, are created to represent financial reporting concepts so they can be reused. These tags are organized into a logical structure, an XBRL taxonomy, to facilitate their use in a digital financial report, called an XBRL instance document. Every XBRL element may have associated with it one or more human-readable labels, which may be in any language. The XBRL IFRS taxonomy defines over 3,000 unique elements that represent financial reporting concepts, yet it remains sufficiently flexible to accommodate additional digital information.

Translating IFRS

The

basis for translating IFRS into XBRL is the same as that which the IASCF uses

to translate IFRS into other languages: The Bound Volume of International

Accounting Standards. In each language, the reference to each IFRS concept

remains consistent. For example, “accounting polices adopted in measuring

inventories” is referenced to IAS 2 paragraph 34(a) and retains the

same reference in every translation.

The

basis for translating IFRS into XBRL is the same as that which the IASCF uses

to translate IFRS into other languages: The Bound Volume of International

Accounting Standards. In each language, the reference to each IFRS concept

remains consistent. For example, “accounting polices adopted in measuring

inventories” is referenced to IAS 2 paragraph 34(a) and retains the

same reference in every translation.

The difficult work of creating the framework of the XBRL IFRS taxonomy and translating the 2002 IAS Bound Volume into XBRL was undertaken by a diverse group of accounting and software experts from several countries (including Germany, France, Singapore, Hong Kong, South Africa, the United Kingdom, and the United States) over the past nine months.

The first task, which was completed during a week-long meeting in Singapore in January 2002, was to produce a draft version of the XBRL IFRS taxonomy. The IFRS taxonomy framework was constructed in a manner that would allow seamless integration with other taxonomies, specifically with jurisdictions that had adopted IFRS either wholly or partially. In addition, the XBRL IFRS taxonomy was to be a foundation for further industry-specific (financial services, extractive industries) and company-specific taxonomies. The design decisions ensured maximum reusability and comparability.

IFRS Common Practices

The XBRL IFRS draft taxonomy was a combination of the following: The 2002 IAS Bound Volume, IFRS-model financial statements and disclosure checklists, and other disclosures typically found in IFRS-compliant financial statements. The result was a draft with two distinct disclosure categories: IFRS-defined (i.e., defined in the 2002 IAS Bound Volume) and IFRS common practice (which included disclosures typically found in IFRS-model and IFRS-compliant financial statements). The common practice disclosures complemented the IFRS disclosures by providing areas into which additional relevant information could reside. An example is “prepayments.” Although not prescribed directly by IFRS, when deemed material, it would be disclosed “when necessary to present fairly the enterprise’s financial position.” (See International Accounting Standards 2002, p. 1-25, paragraph 67.)

Subsequent to the January 2002 meeting in Singapore, the draft taxonomy continued to be developed further by individuals at the meeting. The taxonomy benefited immensely from the global firms that reviewed its content. Following the June 2002 XBRL International meeting in Toronto, a second Singapore meeting was arranged to finalize the XBRL IFRS taxonomy. The result of this meeting was the release candidate of the XBRL IFRS taxonomy using version 2.0 of the XBRL specification. The final release was published in November 2002, coinciding with the XBRL International conference in Tokyo.

XBRL: Use and Reuse

Each

XBRL IFRS element identifies one financial reporting concept. Each element

is based primarily on its references rather than its literal English (or other)

language translation. For example, property plant and equipment carried at

cost and property plant and equipment carried at fair value, while similar

concepts, are represented with unique XBRL IFRS elements, the former referenced

to IAS 16.28 and the latter to IAS 16.29 through 16.40.

Each

XBRL IFRS element identifies one financial reporting concept. Each element

is based primarily on its references rather than its literal English (or other)

language translation. For example, property plant and equipment carried at

cost and property plant and equipment carried at fair value, while similar

concepts, are represented with unique XBRL IFRS elements, the former referenced

to IAS 16.28 and the latter to IAS 16.29 through 16.40.

Uniqueness is a prerequisite for storing, retrieving, analyzing, sharing, and reusing information among computers. Having well-defined and unique XBRL elements invariably leads to less ambiguous information, which is precisely what banks, investors, government agencies, and other financial information stakeholders are demanding. Using the XBRL IFRS taxonomy keeps financial reporting information digital. And keeping information digital facilitates straight-through processing, the transfer of information directly from an entity’s reporting system to systems at financial institutions, stock exchanges, and even investors. Business information is now dynamic, reusable, and ultimately more valuable.

XBRL General Ledger

A financial report that uses the XBRL IFRS taxonomy provides IFRS financial disclosures that are less ambiguous. These disclosures provide a known level of information. A separate but related XBRL international development is the XBRL General Ledger (XBRL GL), which integrates with XBRL IFRS and other structured data formats to preserve the identity and context of information which is typically rolled into a financial report.

The XBRL GL is the bridge between an entity’s financial reporting system and the financial reports themselves. The XBRL GL is an XML-based interface that works with any XML-enabled application or platform. Most important, the XBRL GL makes it possible to drill down from a financial statement disclosure to the events responsible for it, even if the value is an aggregate derived from different information systems or multiple transnational operating units.

Example: XBRL IFRS and GL working together. A company records a transaction in an enterprise resource planning (ERP) system. This transaction is eventually aggregated with similar transactions to produce a summary balance, which is aggregated with transactions from other ERP systems during consolidation. The consolidated figures are then used for multiple purposes: financial reporting, regulatory reporting, tax filings, auditing, and management review and forecasting. The consolidated information may be aggregated and de-aggregated internally for managerial purposes.

There are two key points related to these data aggregations. First, the original data (within the ERP system) has an original context. The left side of Exhibit 1 illustrates several events that need to be measured and recognized. A leasing arrangement will give rise to several entries. For example, event #550 was the purchase on December 31, 2002, of four cars costing $102,000 each. The cash outflow totals $80,000 and the remaining $328,000 is a credit to lease obligations. The context includes an identifier (event #550, a purchase of tangible fixed assets), a medium of exchange for the acquisition (cash and payables), and the value of the acquired assets ($408,000) at a point in time (December 31, 2002). Typically, as these data move through the corporate reporting supply chain, they lose most of their original context, which makes it difficult to trace them back to their sources. XBRL retains as much of the original context as is desired. The ability to rearrange information in a manner more suitable to the data consumer (analyst, banker, auditor, management) results in information that is significantly more valuable.

Second, information that is tagged can be interpreted and analyzed more easily. XBRL tags are designed to carry contextual information with them (Exhibit 2). XBRL IFRS tags carry not only the values related to IFRS concepts, but also each concept’s reference (to the 2002 IAS Bound Volume) and labels (both short and descriptive) in multiple languages.

Investment banks, credit analysts, and other investors currently convert ambiguous paper financial reports back into a digital format using educated guesses and statistical modelling. If they are provided with uniform digital content, such as a file that contains XBRL, the need to guess or model financial figures is diminished significantly and information can be analyzed more quickly and accurately.

The Time Is Now

As XBRL software matures and more XBRL literature becomes available, accounting firms, banks, governmental agencies, software companies, and business information providers will integrate XBRL into their business processes in order to reap its many benefits. The maturity of XML, and a global desire to move corporate reporting into the 21st century, are the prime motivators behind exciting new projects such as XBRL IFRS and XBRL GL. As with any new technology, there is both a learning curve and an adoption period. Its role—to make business information less ambiguous and more reusable—may seem trivial. However, it was not until XBRL International members agreed on how to accomplish this that a project of this significance was achieved successfully on such a scale. The consensus from those who work with corporate reporting information is that the question is not whether information will become less ambiguous and reusable, but rather how soon. How soon, is now.

Editors:

Paul D. Warner, PhD, CPA

Hofstra University

L. Murphy Smith, DBA, CPA

Texas A&M University

The CPA Journal is broadly recognized as an outstanding, technical-refereed publication aimed at public practitioners, management, educators, and other accounting professionals. It is edited by CPAs for CPAs. Our goal is to provide CPAs and other accounting professionals with the information and news to enable them to be successful accountants, managers, and executives in today's practice environments.

Visit the new cpajournal.com.